In the turbulent seas of financial markets, investors often seek a reliable compass to guide their journey towards wealth and security.

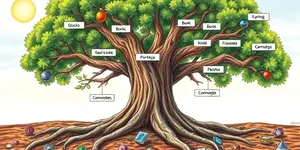

Strategic Asset Allocation (SAA) serves as that steadfast navigator, providing a clear path through uncertainty.

It is a long-term investment strategy that deliberately divides investments across asset classes, such as equities, bonds, and alternatives, to balance risk and return.

By setting fixed targets based on personal factors like risk tolerance and time horizon, SAA offers a disciplined approach that contrasts sharply with short-term market timing.

This method is not just a theoretical concept; it is a proven practice that drives the majority of portfolio performance over time.

Strategic Asset Allocation revolves around creating a diversified portfolio tailored to an investor's unique financial landscape.

It involves establishing target percentages for different asset classes and periodically rebalancing to maintain those allocations.

Over 75% of a portfolio's return variability stems from asset allocation, making it a critical determinant of long-term success.

This approach helps investors avoid the pitfalls of emotional decision-making and impulsive reactions to market fluctuations.

There are two primary methods to implement SAA, each with its own advantages and considerations.

Both approaches emphasize the importance of staying committed to a long-term plan rather than chasing short-term gains.

Diversification is the heart of SAA, spreading investments to reduce risk and enhance stability.

It involves allocating assets across classes, sectors, geographies, and strategies to capitalize on low correlations.

Diversification can lower portfolio volatility by up to 30%, smoothing returns during economic downturns.

This strategy mitigates concentration risk and helps portfolios recover faster from shocks like geopolitical events.

By incorporating multiple layers, investors build a resilient foundation that withstands market cycles.

Historical data consistently shows that diversified portfolios outperform concentrated ones over the long term.

For instance, private equity categories often rotate annually, and a diversified approach captures top performers each year.

SAA has been trusted by institutions and endowments for decades due to its proven track record.

Rebalancing, a key component of SAA, systematically buys low and sells high, boosting returns without market timing.

This evidence reinforces the value of sticking to a strategic plan through economic shifts.

SAA offers numerous advantages that align with investor goals and enhance financial well-being.

These benefits make SAA a cornerstone of prudent financial planning for individuals and institutions alike.

Implementing Strategic Asset Allocation involves a systematic process to ensure alignment with investor needs.

This structured approach provides a clear roadmap for building and maintaining a successful portfolio.

This table highlights why SAA is often preferred for its stability and long-term focus over more reactive strategies.

While SAA is powerful, it is not without its challenges and requires careful consideration.

It does not guarantee profits or eliminate all investment risks, as markets can be unpredictable.

Dynamic SAA introduces model risk and may underperform steady benchmarks in certain conditions.

Investors must maintain discipline and stick to the plan through market cycles, avoiding the temptation to deviate.

By acknowledging these limitations, investors can use SAA more effectively and avoid common pitfalls.

Strategic Asset Allocation is more than just an investment technique; it is a philosophy of resilience and growth.

By building a diversified foundation, investors can navigate financial uncertainties with confidence and clarity.

This approach fosters peace of mind and empowers individuals to achieve their dreams without fear of market whims.

As you embark on your investment journey, remember that consistency and diversification are your greatest allies.

Start today by assessing your goals and crafting a strategic plan that will stand the test of time.

References