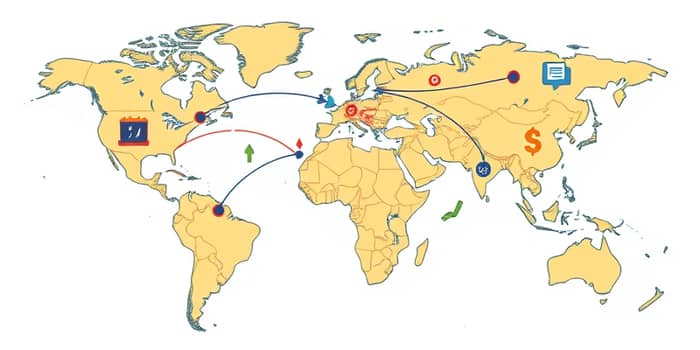

In an era of global connectivity, cross-border asset investments have emerged as a vital pathway for wealth creation and strategic expansion.

These ventures, encompassing mergers and acquisitions, securities, and portfolios, unlock unprecedented opportunities for economic advancement.

Yet, they demand a nuanced approach to balance the geopolitical gains against the inherent challenges.

Cross-border investments offer a gateway to new horizons, driven by the promise of enhanced returns and diversification.

The primary rewards include market access and diversification, allowing investors to tap into unsaturated markets.

This is crucial in today's world, where domestic markets often face saturation.

For instance, U.S. investors have seen stable returns averaging over 3% from international securities over two decades.

This income, when repatriated, fuels domestic job creation and economic growth.

Alongside rewards, cross-border investments are fraught with risks that require vigilant assessment.

Political and economic instability can lead to long-term fallout, such as government shifts or sanctions.

Regulatory hurdles, including tax laws and compliance issues, add layers of complexity.

A Deloitte survey highlights that 33% of executives regret insufficient planning in these areas.

This underscores the need for proactive strategies to mitigate such risks.

Recent surveys provide valuable lessons for investors embarking on cross-border ventures.

Firms that excel often employ early planning and specialized advisors to navigate global instability.

Key regrets from executives include passive negotiations and inadequate market research.

These insights emphasize that success hinges on preparation and adaptability.

To harness the rewards while mitigating risks, a structured approach is essential.

Due diligence must be recalibrated to assess tax stability and compliance thoroughly.

Industry-specific factors, like product certification, should not be overlooked.

This framework helps investors navigate the complexities with confidence.

The global landscape is shifting, with growth decoupling and political flux altering risk profiles.

This paradigm shift affects both developed and emerging economies, requiring adaptive strategies.

Policy implications highlight the need to tackle overseas barriers and enhance cross-border flows.

This context reminds investors that geopolitical dynamics are ever-evolving.

To thrive in cross-border investments, practical steps can make a significant difference.

Begin with comprehensive due diligence and market research to identify opportunities and threats.

Engage local experts early to navigate regulatory and cultural nuances effectively.

By following these steps, investors can transform challenges into sustainable growth opportunities.

Cross-border asset investments, when approached with insight and preparation, offer a path to global prosperity.

References