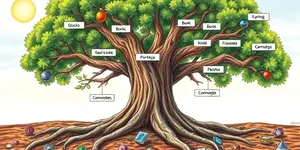

In the fast-paced world of investing, economic indicators serve as the compass guiding every decision.

These metrics provide critical insights into economic health, revealing the pulse of business cycles and corporate potential.

By decoding these signals, investors can anticipate trends, manage risks, and seize opportunities with precision.

This article delves into the essential indicators, their interconnections, and practical strategies for leveraging them in 2026 and beyond.

Economic indicators are not just numbers on a screen.

They are the lifeblood of financial analysis, shaping everything from stock valuations to interest rate expectations.

Understanding them helps investors identify expansion phases or spot contraction risks early.

This knowledge is crucial for aligning portfolios with economic realities.

For instance, rising GDP often signals a robust economy, boosting earnings and supporting equities.

Conversely, high inflation can prompt rate hikes, eroding purchasing power and equity returns.

By staying informed, investors can navigate volatility with greater confidence.

Let's break down the key economic indicators that every investor should monitor closely.

Gross Domestic Product (GDP) measures the total value of goods and services produced.

It is reported quarterly, with trends indicating economic growth or decline.

A strong GDP above 3% growth typically supports risk-on assets like stocks.

Inflation, tracked through CPI and core CPI, reflects price changes over time.

Core CPI excludes volatile food and energy prices for a clearer picture.

Moderate inflation around 2-3% can aid economic growth and risk assets.

High inflation, however, may lead to Federal Reserve rate hikes.

Employment data, including the unemployment rate and job growth, gauges labor market health.

Strong employment boosts consumer spending, driving corporate revenues.

Weakness here can signal recession risks, prompting policy responses.

Other vital indicators include consumer confidence, housing starts, and manufacturing PMI.

Productivity, especially AI-driven gains, is key for long-term earnings margins.

Interest rates, set by the Fed, affect borrowing costs and asset valuations.

For example, rate cuts can support price-to-earnings ratios and housing markets.

Understanding these indicators helps investors make informed decisions.

Economic indicators do not operate in isolation.

They form a complex web where changes in one area ripple through others.

For instance, strong GDP growth can lead to higher inflation if the economy overheats.

This might trigger Fed rate hikes, affecting interest rates and bond yields.

Similarly, employment data influences consumer spending and confidence.

Weak job growth can dampen GDP, creating a feedback loop of economic slowdown.

Interconnections signal business cycle position, helping investors anticipate shifts.

By analyzing these relationships, one can gauge sector performance more accurately.

For example, AI productivity gains might boost long-term margins but come with risks.

Understanding these dynamics is essential for holistic investment strategies.

Looking ahead to 2026, specific trends and policies will shape the investment environment.

The U.S. economy is expected to show resilience with continued expansion.

Early heat-up may occur due to policies like the OBBBA, which provides tax relief.

This could boost corporate earnings by $129 billion over 2026-27.

However, tariffs and immigration restrictions might slow growth in the latter half.

Inflation is forecasted to rise in H1 from tariffs, then fade as core CPI trends lower.

The Federal Reserve is likely to implement shallow rate cuts of 0.5-0.75%.

This could support equities through earnings growth and P/E expansion.

Policy impacts from fiscal stimulus may emerge pre-midterm elections.

Possible tariff rebate checks could boost consumer spending temporarily.

The S&P 500 has shown strong performance, with U.S. stocks leading global markets.

Investors should monitor these developments to adjust their portfolios accordingly.

Applying economic indicators requires practical strategies for real-world investing.

First, use indicators to position portfolios based on the business cycle.

During expansions, overweight cyclical sectors like tech and consumer goods.

In slowdowns, shift to defensives such as utilities or bonds.

Diversify across AI-driven assets to capture long-term productivity gains.

Also, consider supply-constrained assets that may benefit from policy shifts.

Tracking forward-looking indicators like PMI can signal economic turns early.

This allows for proactive adjustments rather than reactive moves.

For example, expansions with Fed rate cuts have historically yielded P/E and earnings gains.

By integrating these strategies, investors can enhance returns and manage risks effectively.

While economic indicators are powerful tools, they are not infallible predictors.

Data can be spotty, such as with immigration statistics affecting labor forecasts.

Indicators require context and historical nuance to interpret correctly.

For instance, high GDP might spark inflation, leading to unexpected rate hikes.

Productivity gains often materialize slowly, requiring patience from investors.

Sentiment shifts can occur rapidly, altering market dynamics overnight.

Therefore, it's crucial to combine indicator analysis with other research methods.

By embracing these caveats, investors can avoid overreliance and make balanced decisions.

Ultimately, mastering economic indicators empowers you to navigate markets with insight and agility.

Start by focusing on core metrics and gradually expand your analysis.

With practice, you'll transform data into actionable wisdom for financial success.

References