Imagine a financial plan that stands strong against market storms and economic shifts. A resilient portfolio is precisely that. It's designed to maintain its value and meet financial objectives over the long haul, no matter the turbulence.

This approach goes beyond mere survival. It empowers you to grow wealth steadily. By focusing on resilience, you invest in peace of mind. You build a system that can adapt and recover.

At its core, resilience means withstanding and recovering from shocks. In investing, this translates to strategies that buffer against volatility. It's about creating a portfolio that performs well across different scenarios.

Whether you're a novice or seasoned investor, this guide offers actionable insights. Let's dive into the principles that make a portfolio truly resilient.

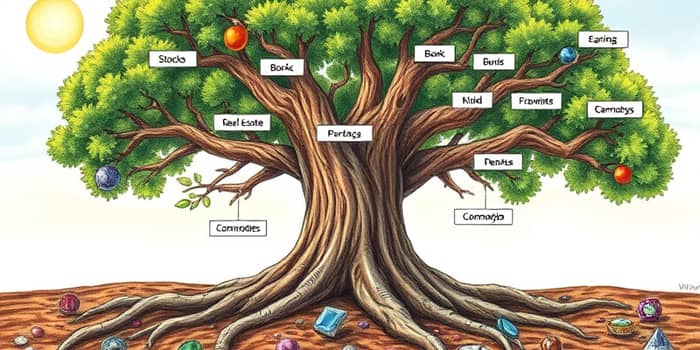

Diversification is the foundation of any resilient portfolio. It involves spreading your investments to reduce risk.

When assets have low correlation, they don't move in sync. This balance helps smooth out returns. It prevents overexposure to any single investment.

Think of it as not putting all your eggs in one basket. Instead, you allocate across various areas. This strategy cushions your portfolio during downturns.

Effective diversification spans multiple levels. Here are the essential dimensions to consider:

Granular diversification adds depth. In private markets, this might mean subdividing real estate into data centers or logistics.

Your risk tolerance shapes your portfolio. Below is a table summarizing allocation models from low to high risk.

Each model tailors investments to specific goals. Low-risk focuses on safety, while high-risk aims for aggressive growth.

Remember, diversification does not eliminate risk entirely. It manages it smartly. Always align allocations with your personal objectives.

To enhance resilience, incorporate advanced techniques. These strategies add layers of protection and growth.

Automation through robo-advisors simplifies this. It makes diversification accessible to everyone. These tools adjust portfolios based on your goals.

Rebalancing keeps your portfolio on track. Over time, asset values shift, altering your allocation.

By adjusting periodically, you maintain your desired risk profile. This prevents drift and ensures diversification benefits.

Set a schedule, like quarterly or annually. Review and rebalance to stay aligned with your strategy. It's a proactive step for long-term success.

Scenario planning helps anticipate future changes. Test your portfolio against various economic scenarios.

This approach defines robust, future-proof strategies. It ensures your investments can thrive in multiple environments.

Mitigate behavioral biases like fear or overconfidence. A disciplined allocation supports consistent outcomes. Stay focused on long-term goals.

Diversification extends to income generation. Beyond traditional fixed-income, consider other options.

These sources complement core strategies. They help build stable income streams over time. Always assess risks and align with your needs.

To put this into action, follow these smart steps:

Consider professional management for expert guidance. It ensures your portfolio matches your risk tolerance. Start small and build gradually.

Crafting a resilient portfolio is a journey, not a destination. It requires ongoing attention and adaptation.

By embracing diversification, rebalancing, and advanced strategies, you create a financial shield. This approach empowers you to weather any season.

Remember, resilience is about more than numbers. It's about securing your dreams and achieving peace of mind. Start today, and build a portfolio that stands the test of time.

References